International Shipping & DeliveryUpdated a year ago

Dynamic Pricing

Prices shown on our website are in US dollars. All marketing offers are based on US Dollars and may not be valid outside of the Continental US.

- International shoppers can use the country selector to adjust the currency viewed. By default, our site will attempt to detect the country from which our website is being visited and display the flag and currency.

- All product pricing is dynamically converted from US Dollars based on the exchange rate at the time of purchase.

- Duty, taxes, and shipping shown on the checkout page are in USD.

- Free Shipping offers apply to orders shipped to the continental US only.

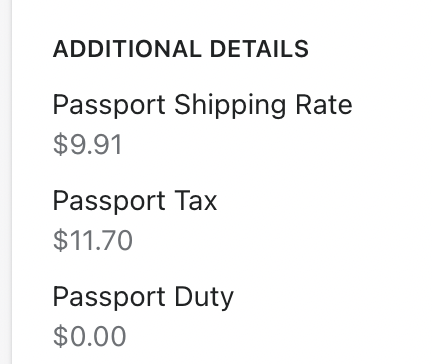

During Checkout, please note the cost breakdown between shipping, duties, and taxes.

We are working with PASSPORT, the international shipping company to clarify their labeling to make this more clear that this total includes Shipping, Taxes, and Duties.

Taxes and duties apply

Taxes and Duties will be itemized at checkout. We ship DDP (delivered duties paid).

| Passport Rate Table: Priority DDP Rates vary by weight, the current exchange rate from USD, and ship to destination. | ||

| Weight (oz) | US Cost | CDN ( Varies with the exchange rate) |

| 1 | $9.23 | 12.00 |

| 5 | $9.56 | 12.43 |

| 10 | $9.95 | 12.94 |

During checkout, you will be able to view your shipping charge, taxes, and any applicable duties

You will see the detailed breakdown of the shipping rate, tax, and duty. paid.

Canadian Taxes

Orders shipped to Canada are subject to the Goods and Services Tax (GST) of 5 percent. The GST is calculated after customs duties have been applied.

Applicable Canadian Provincial Sales Tax (PST) or Quebec Sales Tax (QST) varies between provinces, as do the goods and services to which the tax is applied and how the tax is applied.

In Canadian provinces with a Harmonized Sales Tax (HST) (New Brunswick, Nova Scotia, Newfoundland and Labrador, Ontario, and Prince Edward Island), you'll be charged the HST rather than the separate GST and provincial sales tax.

Canadian Duties

Duties on goods vary widely.

You can estimate duty and taxes on the CBSA, Canada Border Services Agency, website.

The de minimis threshold is the monetary value for courier shipments that can enter Canada without paying duties and taxes. Under CUSMA, Canada has agreed to maintain a de minimis threshold of at least CAD$150.00 for customs duties, and CAD$40.00 for taxes.

Please note duty/taxes paid on import to your country are non-refundable.